The Chief Financial Officer plays an indispensable role within Private Equity Portfolio Companies, steering the financial direction and strategy of these organizations. With private equity sitting on trillions in dry powder, the office of the CFO ensures that companies can measure performance accurately, manage the business efficiently, and make informed investment decisions.

Private Equity’s Mounting Dry Powder

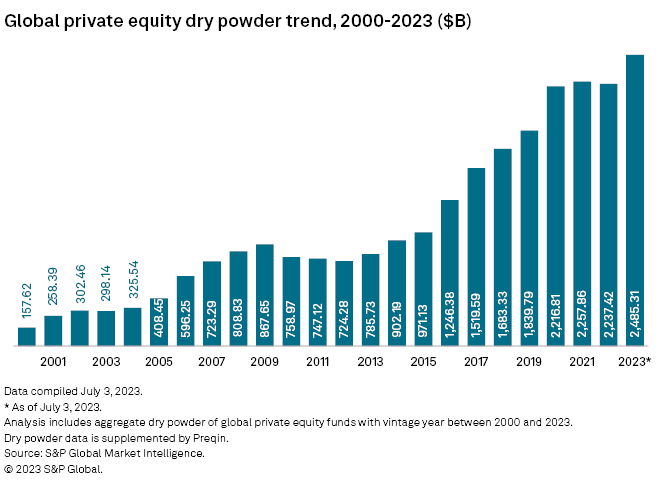

The current scenario in private equity reveals a swelling in dry powder to record highs, amidst a backdrop of sluggish deal-making.

This accumulation is a signal for PE firms to leverage this capital judiciously to drive transformation within portfolio companies, and the first area under the microscope is usually the office of the CFO. The need to establish robust reporting mechanisms is paramount, enabling companies to gauge performance and manage their operations effectively, aligning their actions with strategic financial goals.

The Changing Tenure of CFOs

Despite the critical importance of CFOs, their average tenure is declining. It has become an anomaly for CFOs to hold their positions for more than five years. This shift is largely attributed to the escalating pressures to perform across diverse industries. The demanding nature of private equity makes the first 100 days pivotal for achieving success and gaining the confidence of stakeholders, adding a layer of urgency and strain to top financial leader. Decisions and actions during this period can significantly impact the trajectory of the company and the private equity firm’s ability to realize its investment objectives.

The CFO: A Transformational Role

CFOs in private equity portfolio companies are not mere custodians of financial health; they are transformational leaders, instrumental in reshaping and revitalizing the financial and operational landscapes of these companies. They play a key role in driving organizational change, enhancing operational efficiency, and optimizing financial performance, thus contributing to the overall value creation within the portfolio.

Pressure to Perform and Industry Dynamics

The immense pressure on CFOs can also be seen in the context of the dynamic and competitive industry environment. The rapidly evolving market trends, technological advancements, and regulatory changes require that CFOs stay ahead of the curve, continuously adapting their strategies and approaches to align with the changing industry landscape.

E78 Partners: Aiding CFO Success

E78 Partners works with hundreds of PE firms and their portfolio companies to bolster and support the office of the CFO. Our wide range of services include Interim Resources (including CFOs, Controllers, Accountants), Financial Planning & Analysis (FP&A), Managed Accounting, Finance Technology and Cost Management Solutions. These services are designed to provide the expertise that a CFO needs to successfully navigate the challenges and complexities inherent to the competitive world of private equity.

E78 Partners stands out as a provider of essential support to ensure that the office of the CFO is well-equipped to deliver results. In high stakes environments with intense pressure, leveraging our team’s expertise allows the CFO to focus on driving transformation and value creation within the organization.