In mergers and acquisitions (M&A), integration playbooks offer a structured, cost-effective way to manage the people, processes, and technology requirements. But how do you know when it’s the right time to use them, and what should they include?

We will explore the types of transactions where leveraging a playbook is beneficial and the essential elements needed for smooth and successful integration.

What Is an Integration Playbook? (And What It Isn’t)

Many companies claim to use a “playbook,” but often, it’s merely a vast Excel spreadsheet filled with hundreds of unprioritized tasks, disconnected from the deal thesis. This approach can complicate the integration process rather than simplify the integration process.

A true integration playbook should include the following key elements:

- A proven process and methodology to manage standard integrations and carve-outs.

- Templates for all essential integration and communication planning and execution deliverables.

- A project management platform for seamless deployment.

- Training and implementation support for those managing the playbook.

Let’s break down these elements in more detail.

Process & Methodology

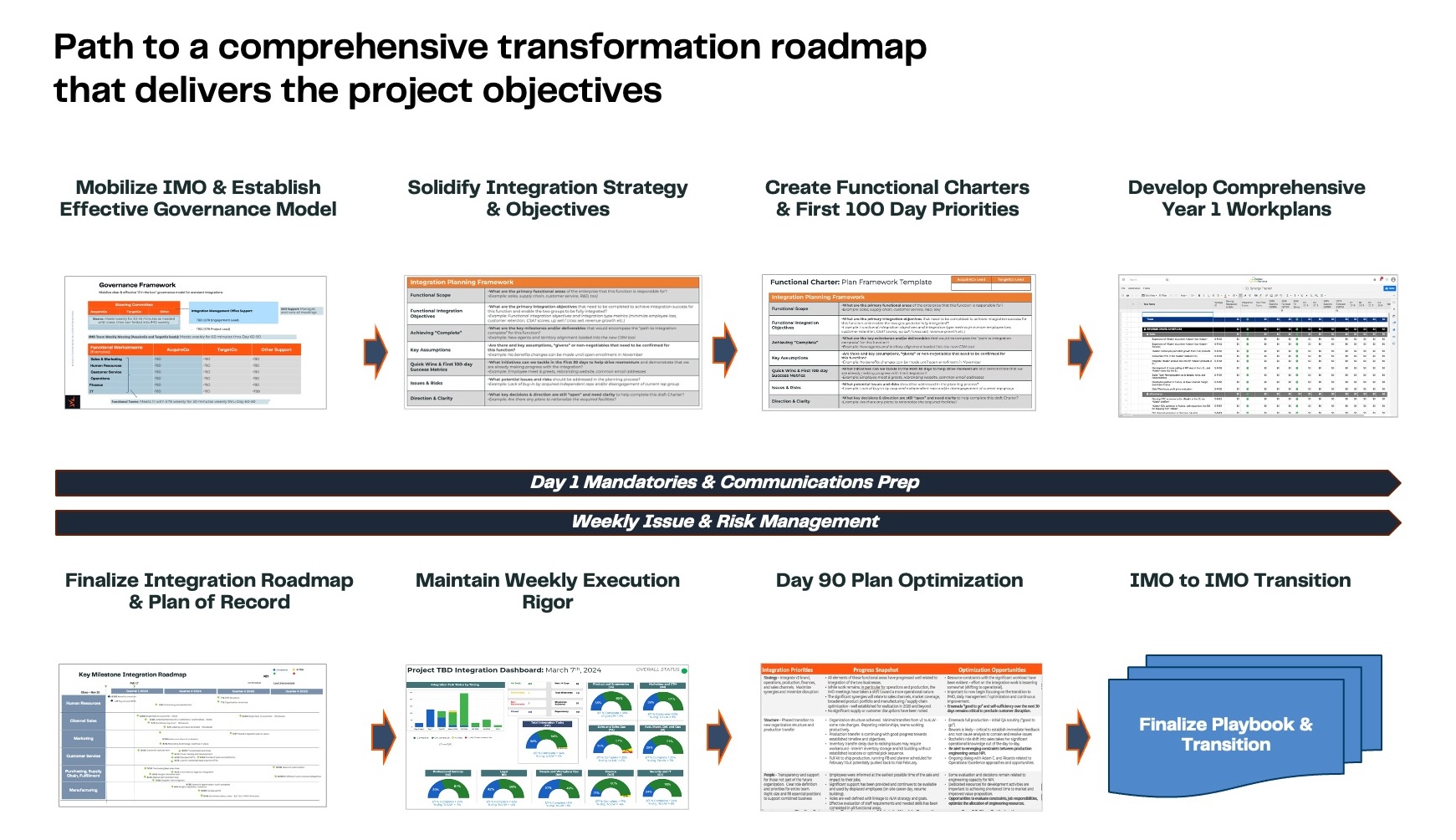

An integration playbook should provide a clear, structured process to transition from the deal thesis to the integration roadmap. Without a well-defined methodology, playbooks often devolve into mere task lists, resulting in what we call “checklist-driven integrations.”

Checklist-driven integrations typically fail to prioritize key objectives, lack proper focus, and are inefficient to manage. A robust playbook should prioritize critical tasks and deliverables, guiding the team through every step of the integration process. Here is an example of key steps and deliverables that should be included in any acquisition playbook:

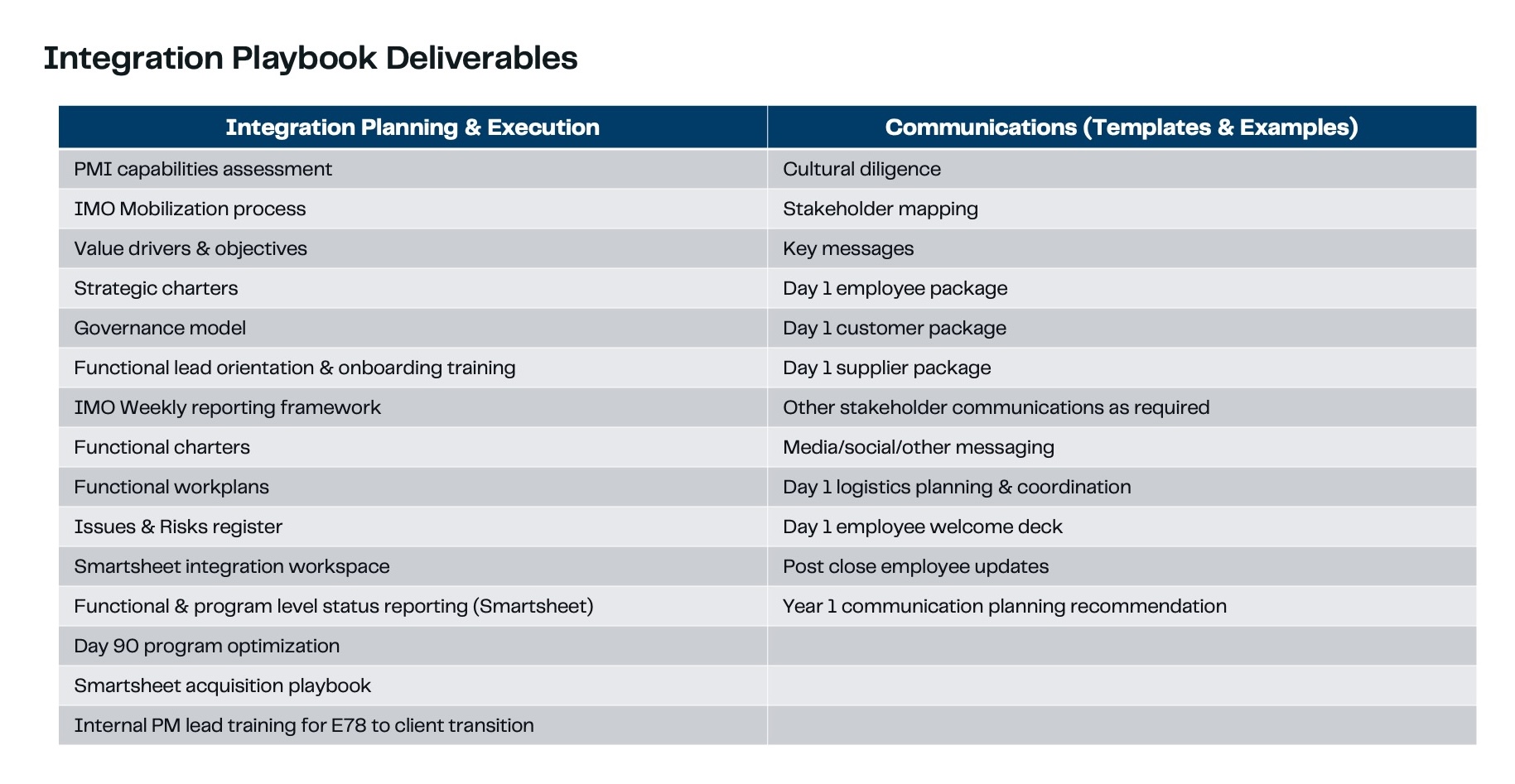

Integration and Communication Templates

Playbooks should contain a comprehensive library of templates that enable teams to streamline planning and execution. These templates reduce rework by offering ready-to-use, customizable forms, making them an essential tool for efficient project management.

Teams should be able to easily access these templates, which serve as a starting point for any integration work.

Playbook Templates

Project Management Platform

Effective playbooks leverage a project management tool that promotes collaboration and document management. While platforms such as Smartsheet can be valuable, it’s essential to choose a tool that is both easy to deploy and cost-effective. Overly complex systems can be difficult to manage during an integration.

The right platform should be intuitive and require minimal training to ensure smooth adoption.

Training & Implementation Support

For a playbook to succeed, adoption is key. Users must understand the value of adhering to the process and using the templates provided.

The most effective way to implement a playbook is through live engagements, which allow for real-time feedback and optimization. Integration Management Office (IMO) leads should also be thoroughly trained on the playbook and have access to support for any troubleshooting needs.

What Types of Deals Are Best Suited for a Playbook?

While integration playbooks are valuable, they are not ideal for every transaction. Situations that are well-suited for a playbook include:

- Lower and middle-market transactions with standard integration needs (e.g., back-office consolidation, Day 1 communications, risk management).

- “First-time” acquisitions for companies beginning an inorganic growth phase. A cost-effective integration solution can help set the foundation for future M&A activities.

- Companies seeking to improve existing capabilities by adopting a more consistent, streamlined approach to integration.

- Roll-ups and asset deals that have predictable requirements across transactions.

For more information about acquisition playbooks and M&A success stories, contact Scott Whitaker.